ACH

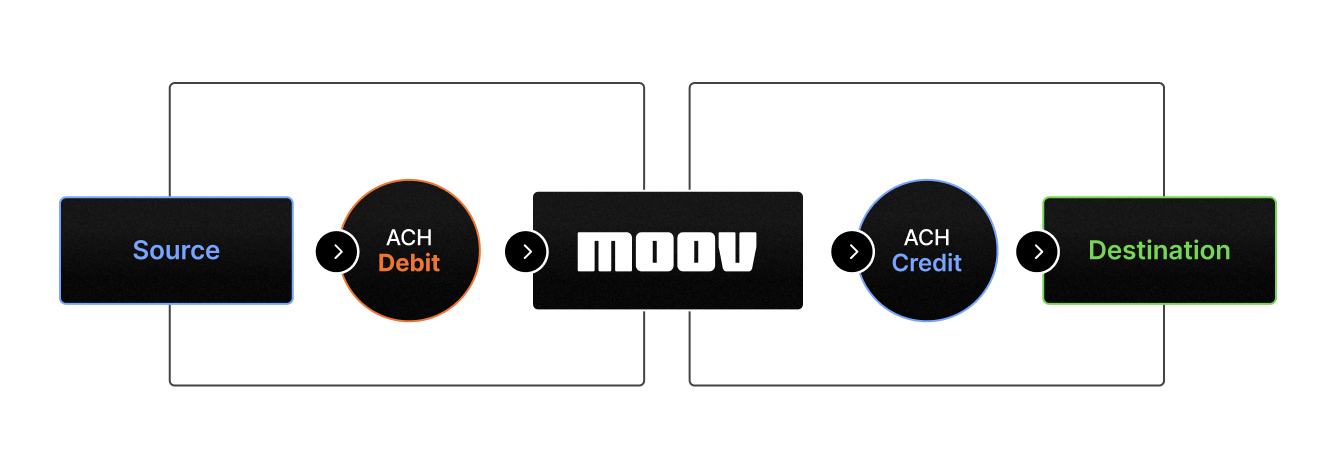

Moov allows you to create payments that directly involve external bank accounts using the ACH network. Automated Clearing House (ACH) transfers are electronic funds transfers between two financial institutions that can both push funds (ACH credits) and pull funds (ACH debits). Moov doesn’t move money directly between external bank accounts; all funds move through the Moov platform on the way to their final destination. In practice, money must move into Moov before it can move out.

This flow can be achieved in a single transfer when the source and destination are both external bank accounts linked to a Moov account. ACH can also be used to add or withdraw funds from a Moov wallet. In order to facilitate an ACH transfer, you will need to ensure the source and destination accounts have the necessary capabilities and payment methods.

Payment methods

Money in

Moov pulls funds into the Moov platform using ACH debits. ACH debits can be created using a payment method with the types:

ach-debit-fund

- Represents a “push” flow (e.g. payout or disbursement)

- The source account will see

Moovon their statement - The destination account will see the source’s

displayNameon their statement

ach-debit-collect

- Represents the first stage of a “pull” flow (e.g. destination billing the source account)

- The source account will see the destination’s

displayNameon their bank statement

Money out

Funds leave the Moov platform with ACH credits. You can specify the processing speed using the payment method types:

ach-credit-standard

- Payment is processed with standard “next day” ACH processing

- Takes 1-2 banking days

- If the transaction is initiated before the 5:30 pm ET cut off, it should be posted in the external bank account the next banking day

ach-credit-same-day

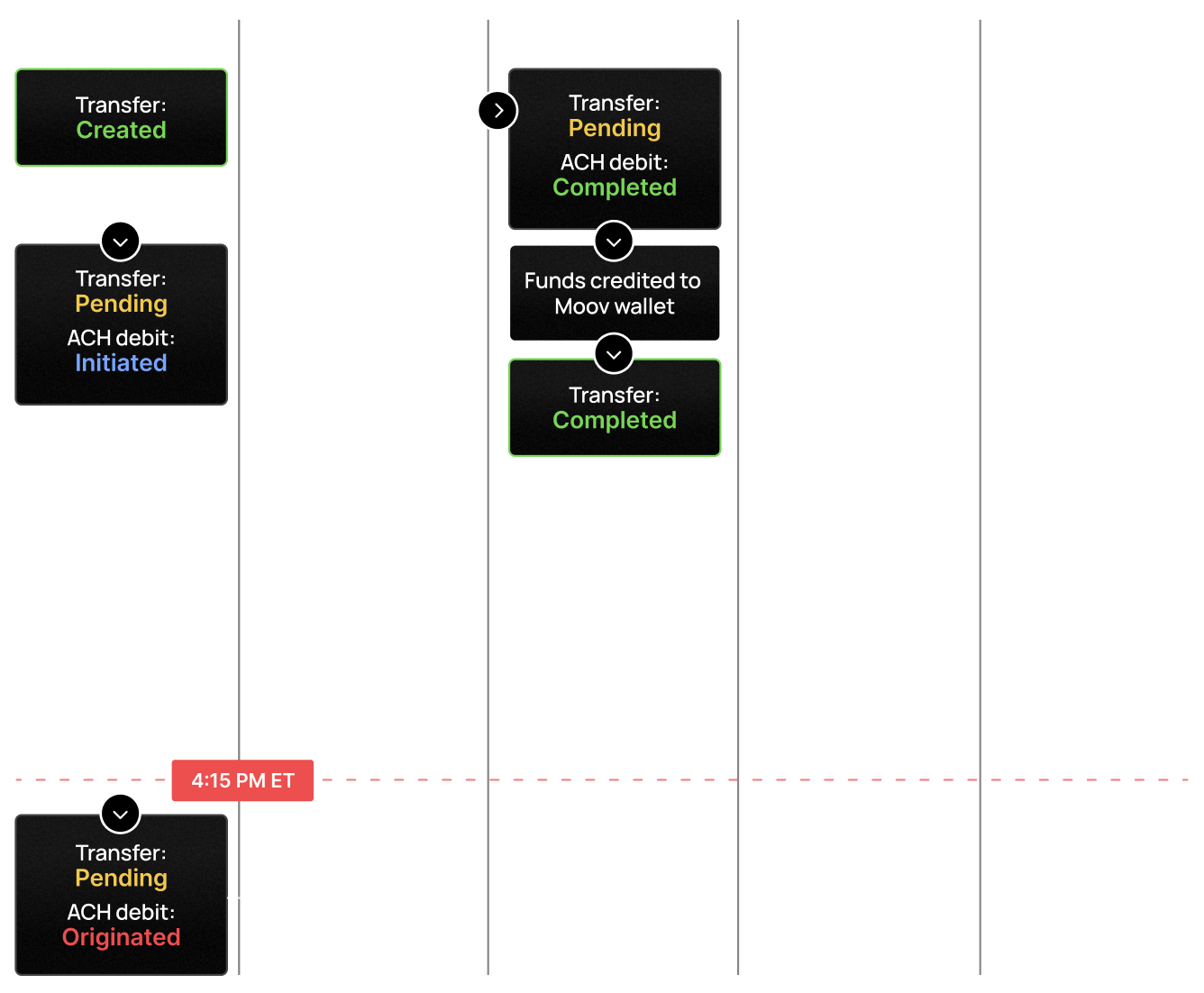

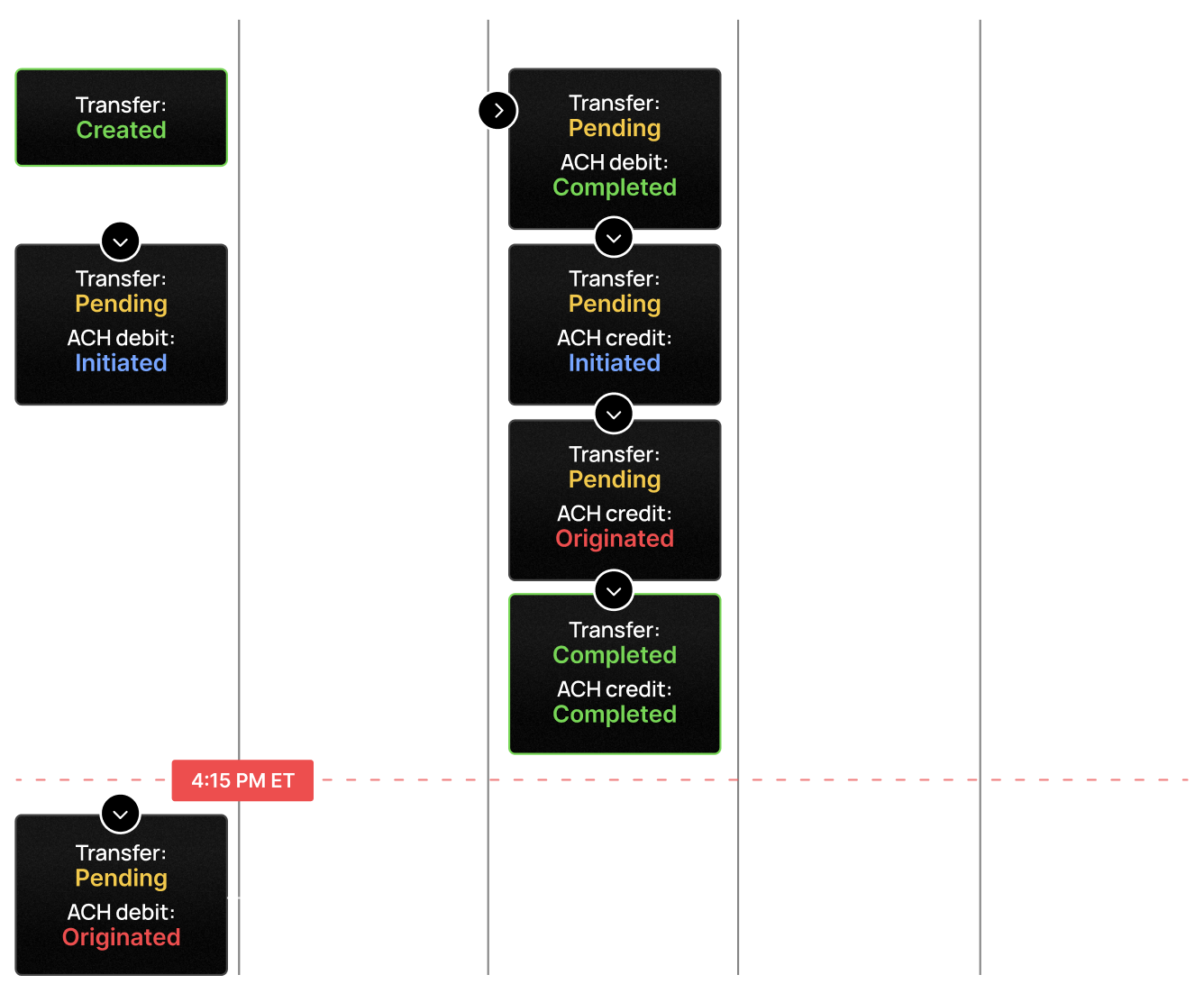

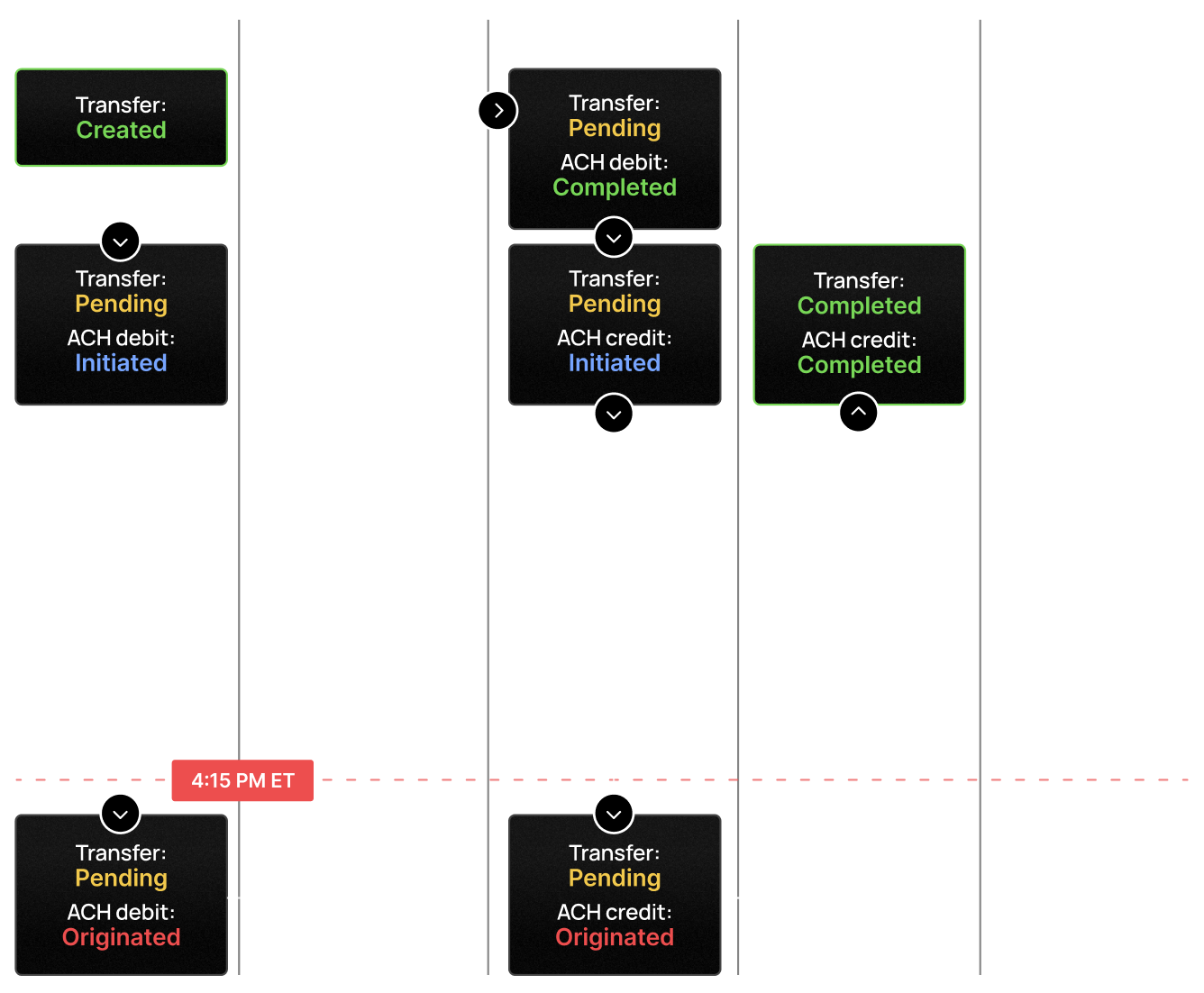

- Payment is processed with “same-day” ACH processing

- If the transaction is initiated before the final 4:15 pm ET cut off, it should be posted in the external bank account by the end of the day

- It is possible that same-day credits may be posted earlier (see additional same-day processing information below)

ACH processing and cutoff times

ACH payments are processed in batches and must be uploaded to Moov’s partner financial institutions before certain cutoff times. In general, “no news is good news”: the payment succeeded unless you receive a subsequent return file stating that it did not. To account for the time lag to hear back about returns or processing issues, Moov holds funds that enter the Moov platform via an ACH debit for 2-3 banking days before making the funds available. In most circumstances, funds are made available in the morning of the second banking day after the transfer was created e.g., Wednesday for a Monday transfer.

If the transfer is created after a cutoff time, it will be processed according to the same schedule on the next banking day. Banking days refer to M-F excluding bank holidays.

ACH cutoff times

| Processing speed | Cut-off time | Expected time posted to bank |

|---|---|---|

| Same-day window 1 | 10:00 am ET | Early afternoon |

| Same-day window 2 | 2:15 pm ET | End of day |

| Same-day window 3 | 4:15 pm ET | End of day |

| Standard | 5:30 pm ET | Next day |

Same-day processing

To expedite the transfer process, Moov processes all ACH debits with same-day processing when available. You can request ACH credits to be processed same-day by using an ach-credit-same-day payment method as the transfer destination. Moov processes in all same-day windows.

ACH details

You can obtain details about a transfer involving the ACH payment rail through the GET /transfers/{transferID} endpoint. If the source or destination uses an ACH payment method, the transfers details response will contain an achDetails sub-object that contains useful information such as:

traceNumber: tracking number (assigned by Moov) that can used by payment recipient to trace the payment with their external financial institutionreturn: ACH return information per Nacha specificationcodereasondescription

correction: ACH notification of change information per Nacha specificationcodereasondescription

Additionally, the achDetails contains rail-specific status information:

ACH statuses

| Status | Description |

|---|---|

initiated |

The ACH transfer from the source into Moov’s system has been created |

originated |

Payment instructions about the source transfer have been sent to Moov’s originating depository financial institution (ODFI) partner |

corrected |

The source transfer completed but a notification of change was received |

completed |

Funds are available in Moov and ready to flow out to the destination |

returned |

The payment was returned by Moov to the source financial institution |

Customized ACH statement descriptors

We allow you the option to set a customized ACH statement descriptor when creating a transfer. If you’d like to provide more clarity or context for an individual transfer, you can utilize the following fields:

achDetails.companyEntryDescription: describe the purpose of the transactionachDetails.originatingCompanyName: set how you want the company name to appear on the statement

The string you provide in those fields will override the default Nacha file entry. If you’d like to set custom descriptors, you can use these fields for both the source and destination, or just one.

In a transfer where the source and the destination are the same Moov account, the facilitator’s ACH company name will be used as the default originating company name. The facilitator can override this value by setting the achDetails.originatingCompanyName field for either the source or the destination in the transfer creation request.

FAQ